39 tax on gift card

› forms-pubs › about-form-1099-miscAbout Form 1099-MISC, Miscellaneous Income - IRS tax forms Sep 28, 2022 · Information about Form 1099-MISC, Miscellaneous Income, including recent updates, related forms and instructions on how to file. Form 1099-MISC is used to report rents, royalties, prizes and awards, and other fixed determinable income. Gift Tax: Tax Rules to Know if You Give or Receive Cash Cash gifts can be subject to tax rates that range from 18% to 40% depending on the size of the gift. The tax is to be paid by the person making the gift, but thanks to annual and lifetime...

2022-2023 Gift Tax Rate: What Is It? Who Pays? - NerdWallet What is the gift tax rate? If you're lucky enough and generous enough to use up your exclusions, you may indeed have to pay the gift tax. The rates range from 18% to 40%, and the giver...

Tax on gift card

› individuals › international-taxpayersU.S. Citizens and Resident Aliens Abroad | Internal Revenue ... If you are a U.S. citizen or resident alien (including a green card holder) and you live in a foreign country, and you are: Requesting a refund, or no check or money order enclosed, mail your U.S. tax return to: Department of the Treasury Internal Revenue Service Austin, TX 73301-0215 USA. Enclosing a check or money order, mail your U.S. tax ... Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot Software Follow these steps to determine how much to withhold from the gift card for taxes: First, multiply the gift card value by 22% to find the federal income tax: $100 X 0.22 = $22.00 Now, multiply the gift card value by 6.2% to find the Social Security tax (unless the employee has reached the Social Security wage base ): $100 X 0.062 = $6.20 › estate-taxEstate Tax | Internal Revenue Service - IRS tax forms The Estate Tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at the date of death (Refer to Form 706 PDF). The fair market value of these items is used, not necessarily what you paid for them or what their values were when you acquired them.

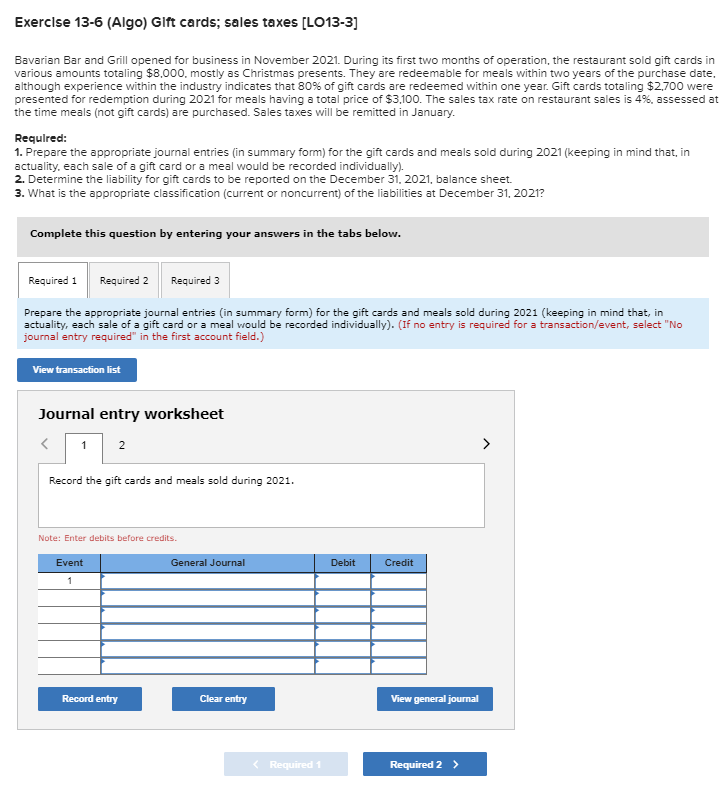

Tax on gift card. Sales Tax and Gift Certificates - AccurateTax.com Sales Tax and Gift Certificates. Last updated October 5, 2022. Many online retailers reap the benefit of gift-giving, especially for shoppers buying presents for friends and family who live elsewhere. Whether you are a business that focuses primarily on gifts, such as gift basket or flower delivery service, a shop that rarely caters to the gift ... Is There Tax On Gift Cards For Employees? (& Other Related Questions ... This article will help ease that uncertainty by tackling the complex issue of how gift cards are taxed. Is There Tax On Gift Cards? The short and simple answer is yes, there is tax on gift cards. According to the U.S. Internal Revenue System (IRS) website, a gift card is classified as an additional compensation measure. It's a fringe ... Gift Tax | Internal Revenue Service - IRS tax forms The gift tax is a tax on the transfer of property by one individual to another while receiving nothing, or less than full value, in return. The tax applies whether or not the donor intends the transfer to be a gift. The gift tax applies to the transfer by gift of any type of property. IRS Details the Federal Income Tax Consequences of Gift Cards According to the IRS attorneys, taxpayers who issue gift cards are to recognize income for federal tax purposes when its gift cards are purchased. The IRS attorneys also conclude that taxpayers are not able to deduct the expense until the time that the gift cards are used. Here is an example based on the conclusion reached by the IRS attorneys.

Retailers must be mindful of gift card tax pitfalls Nov 21, 2019. #. Business tax Restaurant Retail Grocery. While it is widely accepted that a well-designed and well-executed gift card program can drive customer traffic, increase sales and build customer loyalty, retailers and restaurant operators must be mindful of the ASC 606 financial reporting and tax consequences of their gift card ... Mastercard® Gift Cards | Liberty Federal Credit Union Available now at any Liberty FCU office for only $2.00 per card! Mastercard® Gift Cards can be used most anywhere* Mastercard debit or credit cards are accepted, including most merchants and on the internet. Liberty FCU's Mastercard® Gift Cards are available in any denomination between $20 and $500 and feature lower fees than those charged ... Frequently Asked Questions on Gift Taxes - IRS tax forms Frequently Asked Questions on Gift Taxes Below are some of the more common questions and answers about Gift Tax issues. You may also find additional information in Publication 559 or some of the other forms and publications offered on our Forms page. Included in this area are the instructions to Forms 706 and 709. PDF New IRS Advice on Taxability of Gift Cards Treatment of ... - IRS tax forms and any unused portion is forfeited). However, Federal tax law does not view giving an employee a turkey or a ham as the equivalent of giving an employee a gift card to purchase a turkey or a ham. A recently issued Tax Advice Memorandum (TAM) in 2004 clarifies the tax law and discusses this issue.

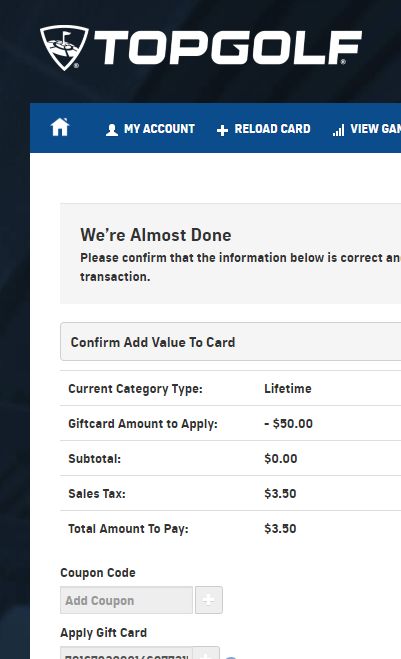

Reminder to all taxpayers: Gift cards are not used to make tax payments ... Once the taxpayer buys the gift cards, the scammer will ask the taxpayer to provide the gift card number and PIN. Here's how taxpayers can tell if it's really the IRS calling. The IRS will never: Call to demand immediate payment using a specific payment method such as a gift card, prepaid debit card or wire transfer. Should I tax customers for gift cards? - Avalara For example, the recipient could use a $100 card for 50 $2 purchases or put it toward one $200 purchase. The recipient could use the card in California or Maine, at your location or at one in a jurisdiction that charges a higher local sales tax. When buying gift cards, make sure you aren't charged sales tax. The sales tax on the monetary value of the gift card is charged when the recipient ultimately uses the card to make purchases, therefore no state in the U.S. requires retailers to charge sales taxes on the purchase of gift cards. Are Employee Gift Cards Considered Taxable Benefits? - Strategic HR According to the IRS, cash, gift certificates, and gift cards are considered taxable fringe benefits and must be reported as wages. But you may be relieved to know that this rule doesn't apply to all gifts or perks that you may give to employees. The IRS tells us that we can exclude the value of a "de minimis" benefit from an employee's wages.

How To Tax Gift Cards In Payroll? - Law info How much tax do you pay on a gift card to an employee? To give your employees a gift card with a value of $100 after taxes, record it as $142.15 gross and withhold $42.15 for taxes. When you give gift cards to employees, include the value in the employee's wages on Form W-2. Are gift cards subject to payroll taxes?

› estate-and-gift-taxesEstate and Gift Taxes | Internal Revenue Service - IRS tax forms Gift Tax If you give someone money or property during your life, you may be subject to federal gift tax. Frequently Asked Questions on Gift Taxes Find some of the more common questions dealing with gift tax issues as well as some examples of how different types of gifts are treated. Filing Estate and Gift Tax Returns

› newsroom › estate-and-gift-tax-faqsEstate and Gift Tax FAQs | Internal Revenue Service Q. How did the tax reform law change gift and estate taxes? A. The tax reform law doubled the BEA for tax-years 2018 through 2025. Because the BEA is adjusted annually for inflation, the 2018 BEA is $11.18 million, the 2019 BEA is $11.4 million and for 2020, the BEA is $11.58 million. Under the tax reform law, the increase is only temporary.

Gift Tax FY 2021-22: What is Gift Tax? & Exemptions of Tax on Gifts Gifts that you get is now tax-free up to a limit. You will have to pay taxes on the gifts you get if the value of the same is more than Rs.50,000. Gifts valued up to Rs.50,000 are tax free. If the amount is over the limit, then the entire amount of your gift will be taxable. For example: if you get Rs.55,000 as gifts during this financial year ...

› estate-taxEstate Tax | Internal Revenue Service - IRS tax forms The Estate Tax is a tax on your right to transfer property at your death. It consists of an accounting of everything you own or have certain interests in at the date of death (Refer to Form 706 PDF). The fair market value of these items is used, not necessarily what you paid for them or what their values were when you acquired them.

Are Gift Cards Taxable? | Taxation, Examples, & More - Patriot Software Follow these steps to determine how much to withhold from the gift card for taxes: First, multiply the gift card value by 22% to find the federal income tax: $100 X 0.22 = $22.00 Now, multiply the gift card value by 6.2% to find the Social Security tax (unless the employee has reached the Social Security wage base ): $100 X 0.062 = $6.20

› individuals › international-taxpayersU.S. Citizens and Resident Aliens Abroad | Internal Revenue ... If you are a U.S. citizen or resident alien (including a green card holder) and you live in a foreign country, and you are: Requesting a refund, or no check or money order enclosed, mail your U.S. tax return to: Department of the Treasury Internal Revenue Service Austin, TX 73301-0215 USA. Enclosing a check or money order, mail your U.S. tax ...

![Land Tax [Judge Gift Cards 2010] – Alpha Strike Gaming](https://cdn.shopify.com/s/files/1/0200/2917/7910/products/af3bb1d2-4214-49b6-9efa-c8e1902e2e07.jpg?v=1569486084)

0 Response to "39 tax on gift card"

Post a Comment